When you incorrectly claim your favorite hobby as a small business, it’s like waving a red flag that says “Audit Me!” to the IRS. However, there are tax benefits if you can correctly categorize your activity as a small business.

Why does hobby versus business activity matter?

Chiefly, you’re allowed to reduce your taxable income by the amount of your qualified business expenses, even if your business activity results in a loss.

On the other hand, you cannot deduct losses from hobby activities. Hobby expenses are treated as miscellaneous itemized deductions and don’t reduce taxable income until they (and other miscellaneous expenses) surpass 2 percent of your adjusted gross income.

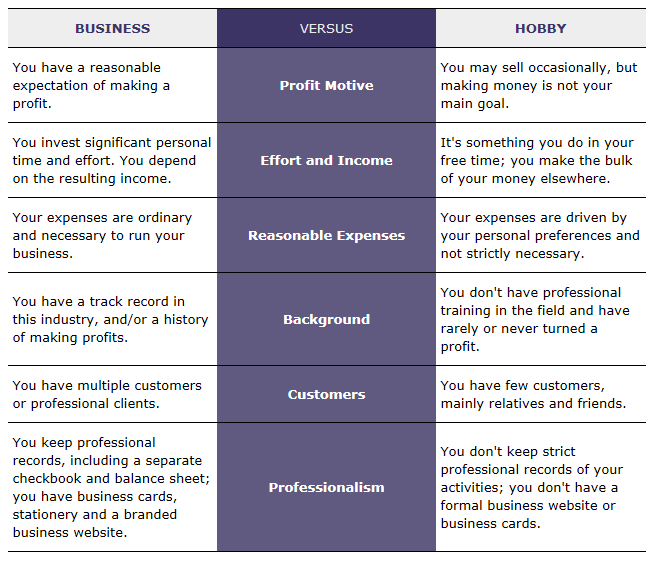

Here are some tips to determine whether you can define your activity as a business.

BUSINESS VERSUS HOBBY

The IRS will consider all these factors to make a broad determination whether you operate your activity in a businesslike manner. If you need help ensuring you meet these criteria, reach out to schedule an appointment.